888.711.RISK

Umbrella Coverage

Protect your business with additional coverage beyond your current policies.

Coverage for additional protection

Umbrella coverage goes beyond your primary liability insurance policies to provide additional protection for your business. This type of coverage offers higher limits to safeguard your company in the event of a catastrophic loss that exceeds the limits of your other policies.

Address the following risks with umbrella coverage

Contractors face unique challenges that make umbrella coverage essential.

- Property damage: This includes damage to someone else’s property, such as if you accidentally cause a fire in a rental property you own.

- Excessive lawsuits: This helps pay for legal fees and court costs if you are sued and need to defend yourself.

- Unforeseen accidents: Valuable protection for those unexpected and potentially costly events that can happen in life.

Bodily injury: This includes claims for injuries or death that occur due to your negligence, such as if someone slips and falls on your property.

Personal injury: This includes claims for libel, slander, defamation, or invasion of privacy.

By providing additional coverage beyond the limits of standard policies, umbrella coverage can protect construction companies from financial losses and potential bankruptcy.

Safety-focused contractors receive more discounts.

Today, we have technology proven to reduce risk. This gives safety-focused contractors an opportunity for better coverage at lower rates. Here’s how we use innovative insurance solutions, AKA: Real-Time Risk Management, to help contractors boost productivity, protect their operations, and win more jobs.

Reduce risk and costs across all lines of insurance

Fleet management technology impacts more than your equipment insurance. Connected assets reduce risk across the board.

Objective dashcam footage of incidentsFewer paid auto claims =

Operator behavior warnings =Fewer commercial insurance claims

Location and usage data = Fewer theft and third-party liability claims

Timely maintenance =Less downtime and loss of use claims

With an improved claims experience and a proven commitment to managing risk, you’re in the best position for the best rates. We’ll help you get them.

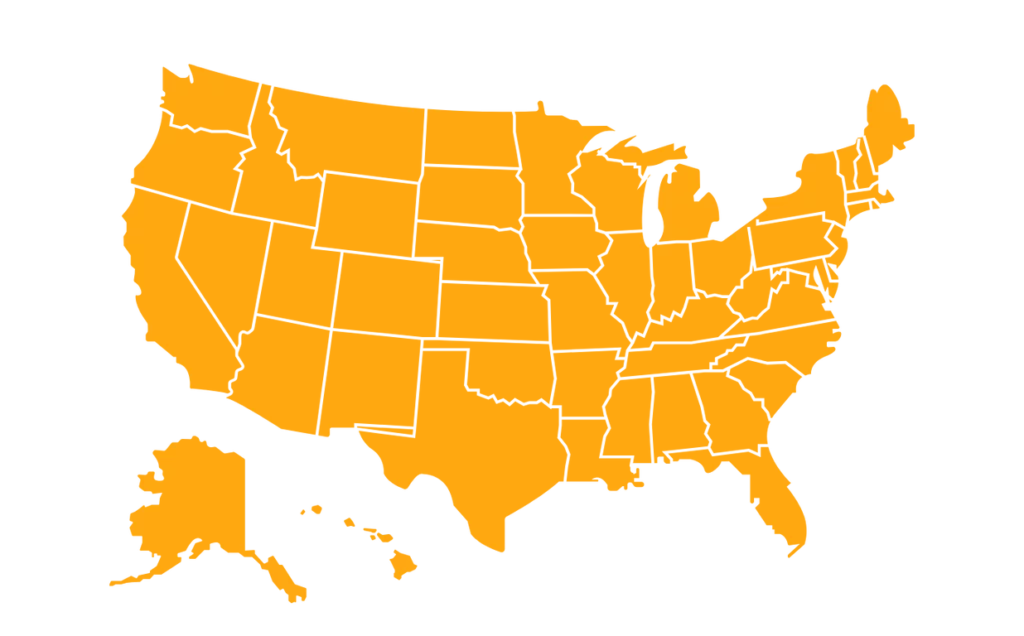

Multi-state coverage for contractors of all trades

Leif is actively building the next big cost-saving program for construction insurance. Creatively serving contractors of all shapes and sizes, we offer customized coverage for:

- Artisan Contractors

- Bridge & Infrastructure Contractors

- Concrete Contractors

- Demolition Contractors

- Electrical Contractors

- Excavation Contractors

- General Contractors

- HVAC Contractors

- Landscaping Contractors

- Municipal Contractors

- Oil & Gas Contractors

- Plumbing Contractors

- Street & Road Contractors

- Structural Steel Contractors

- Other specialized trades

Umbrella Coverage FAQs

What is umbrella coverage?

Umbrella coverage is additional liability insurance that provides extra protection beyond the limits of your existing policies. It is designed to protect you from major claims and lawsuits, and can help to safeguard your assets in the event of a catastrophic event. Umbrella coverage typically kicks in when your other insurance policies have reached their coverage limits, providing you with an additional layer of protection and peace of mind. It’s important to consider umbrella coverage if you have significant assets or liabilities, as it can help to protect you from financial ruin in the event of a major lawsuit or claim.

How much umbrella coverage do I need?

The amount of umbrella coverage you need depends on several factors, such as:

- The value of your assets: Consider the total value of your assets, including your home, vehicles, and any other property you own.

- Your level of risk: If you have a higher risk of accidents or lawsuits, you may need more liability coverage.

- Your budget: Umbrella insurance policies are available in different coverage limits, so you should choose one that fits your budget.

- Your peace of mind: If you want to have additional protection and peace of mind, you may want to opt for higher umbrella coverage.

It’s important to consult with an insurance professional to determine the right amount of umbrella coverage for your specific needs and circumstances.

Do I need to have certain types of insurance in place before getting umbrella coverage?

Before getting a commercial umbrella coverage, it is recommended to have certain types of insurance in place, such as:

- General liability insurance

- Commercial auto insurance

- Employer’s liability insurance

- Professional liability insurance

- Workers’ compensation insurance

These policies provide various types of coverage for different areas of your business and help protect you from financial losses due to unexpected events. Having these policies in place before obtaining a commercial umbrella coverage can provide an additional layer of protection and may even help lower the cost of the umbrella policy. It is always best to consult with an insurance professional to determine the specific insurance needs for your business.

More than an insurance agent:

Our Consultative Approach

As your construction operation grows, your risks compound. Leif’s in-house experts help you create risk and bond strategies tailored to your business.

At Leif, we use a consultative approach to provide ongoing guidance. Our proven five-step process ensures your risk management plan aligns with your goals.

Personalized serviceyou can count on, every time

We deliver exceptional service across all lines of insurance by promising to:

- Identify coverage gaps and quickly secure new policies

- Partner with strong carriers to offer the best program available

- Respond quickly to calls, texts, and chat during business hours

- Offer after-hours claims consultation for 24/7 emergency support

- Deliver most COIs within 2 business hours and bonds overnight

- Create a strategy to maximize your bond capacity for growth

Whether you’re a large multi-state firm, local trade contractor, or something in between – you can hold us to our promise.