888.711.RISK

Fleet Management Tech Users:

Safety-focused contractors qualify for lower rates!

Just by using your fleet management technology you qualify for insurance savings up to 15%

The data is in: Fleet Management Software improves safety

We’ve collected 250,000,000 miles’ worth of driving data. (That’s roughly the distance from here to Mars.)

What has all that data taught us? We’ve found that fleet management technology reduces collisions per million miles driven by 10%. We know it works. That’s why we have the confidence to give fleet management users lower insurance rates.

Leif customer saves $62,000 on premium

“My company operates 14 semi-trucks hauling ethanol in the Midwest. I invested in dashcam technology to be a more efficient and safe operation but I was not getting any benefit on my insurance program until I met the folks at Leif. Leif increased my umbrella coverage $2 million and saved us $62,000 on commercial auto spend.”

Save up to 15% on Commercial Auto

Dashcam technology helps you reduce claims and demonstrate to carriers that you prioritize fleet safety.

How?

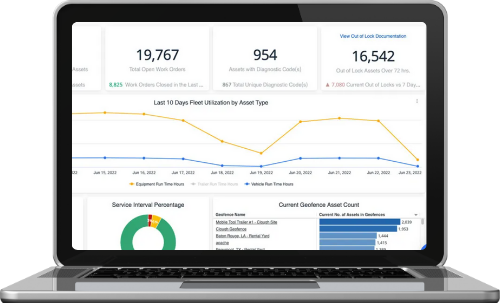

With real-time access to this information, you reduce risk and increase efficiency by:

- Using the objective footage to resolve claims and mitigate disputes

- Locating lost or stolen vehicles

- Implementing employee training to improve driver behaviors

Your insurance rates should reflect your safety measures.

Reduce costs across all lines of insurance

Fleet management tools help you reduce risk across the board. Get ahead of the game as the industry shifts to data-driven pricing on workers’ compensation, equipment insurance, commercial auto, and more.

Which policies are right for you?

With our diverse network of top-rated carriers, we can write any insurance program tailored to your risks.

Workers' Comp

Coverage for your employees from the financial impact of workplace injuries

Builder's Risk

Protection for buildings and structures during construction or renovation

Umbrella Coverage

Protection from losses that exceed the limits of your other policies

Personalized serviceyou can count on, every time

We deliver exceptional service across all lines of insurance by promising to:

- Identify coverage gaps and quickly secure new policies

- Partner with strong carriers to offer the best program available

- Respond quickly to calls, texts, and chat during business hours

- Offer after-hours claims consultation for 24/7 emergency support

- Deliver most COIs within 2 business hours and bonds overnight

- Create a strategy to maximize your bond capacity for growth

Whether you’re a large multi-state firm, local trade contractor, or something in between – you can hold us to our promise.